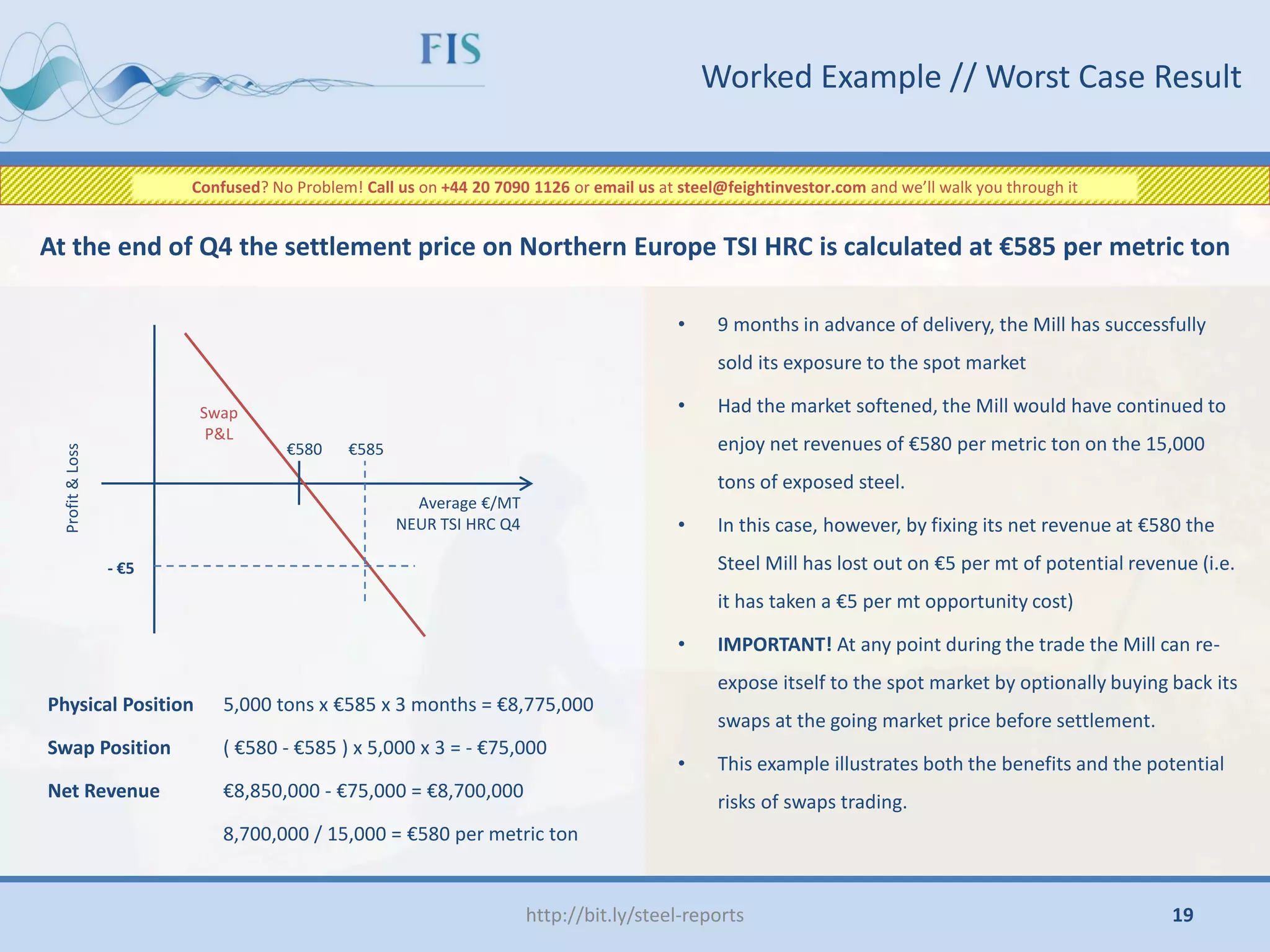

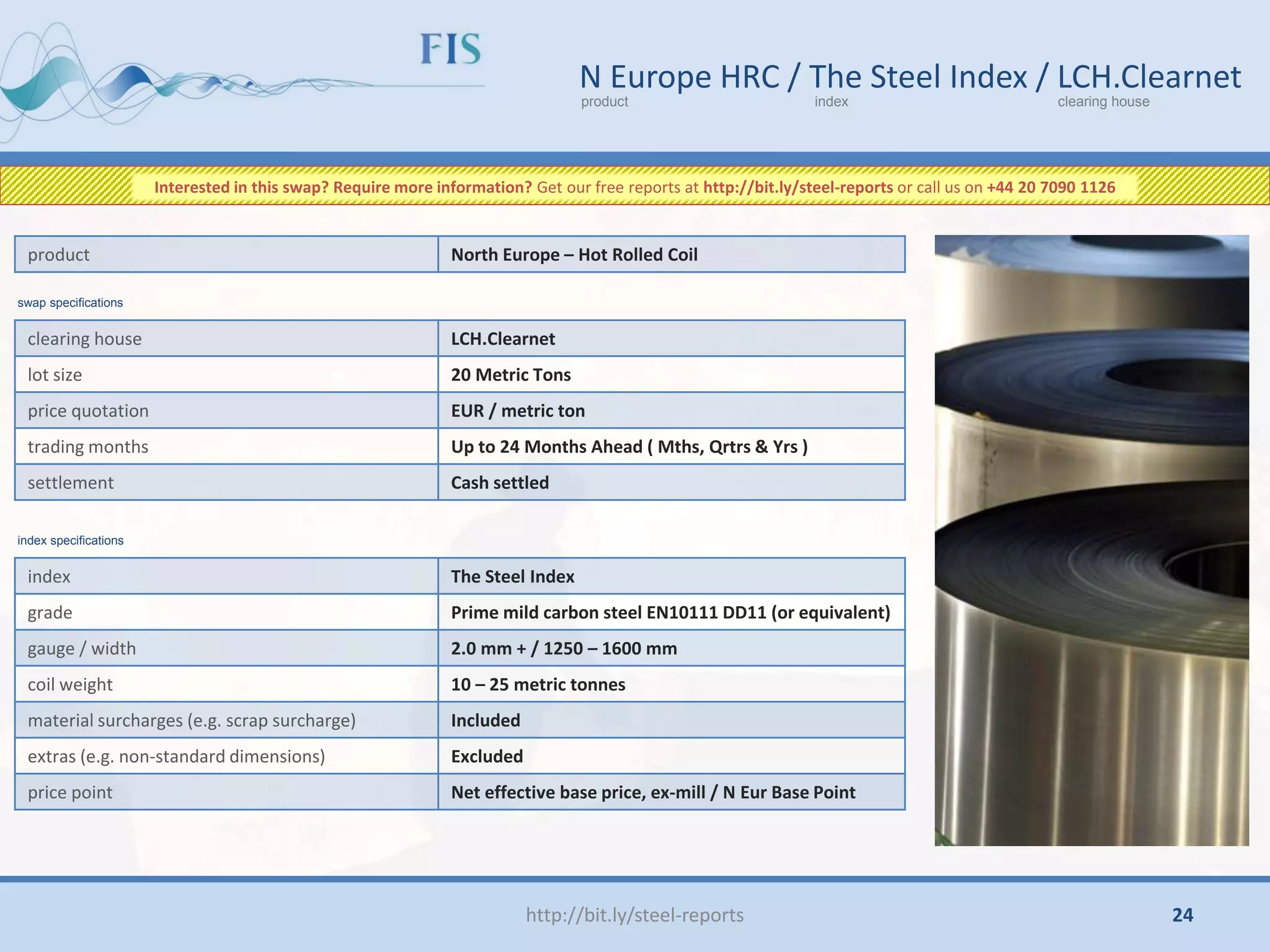

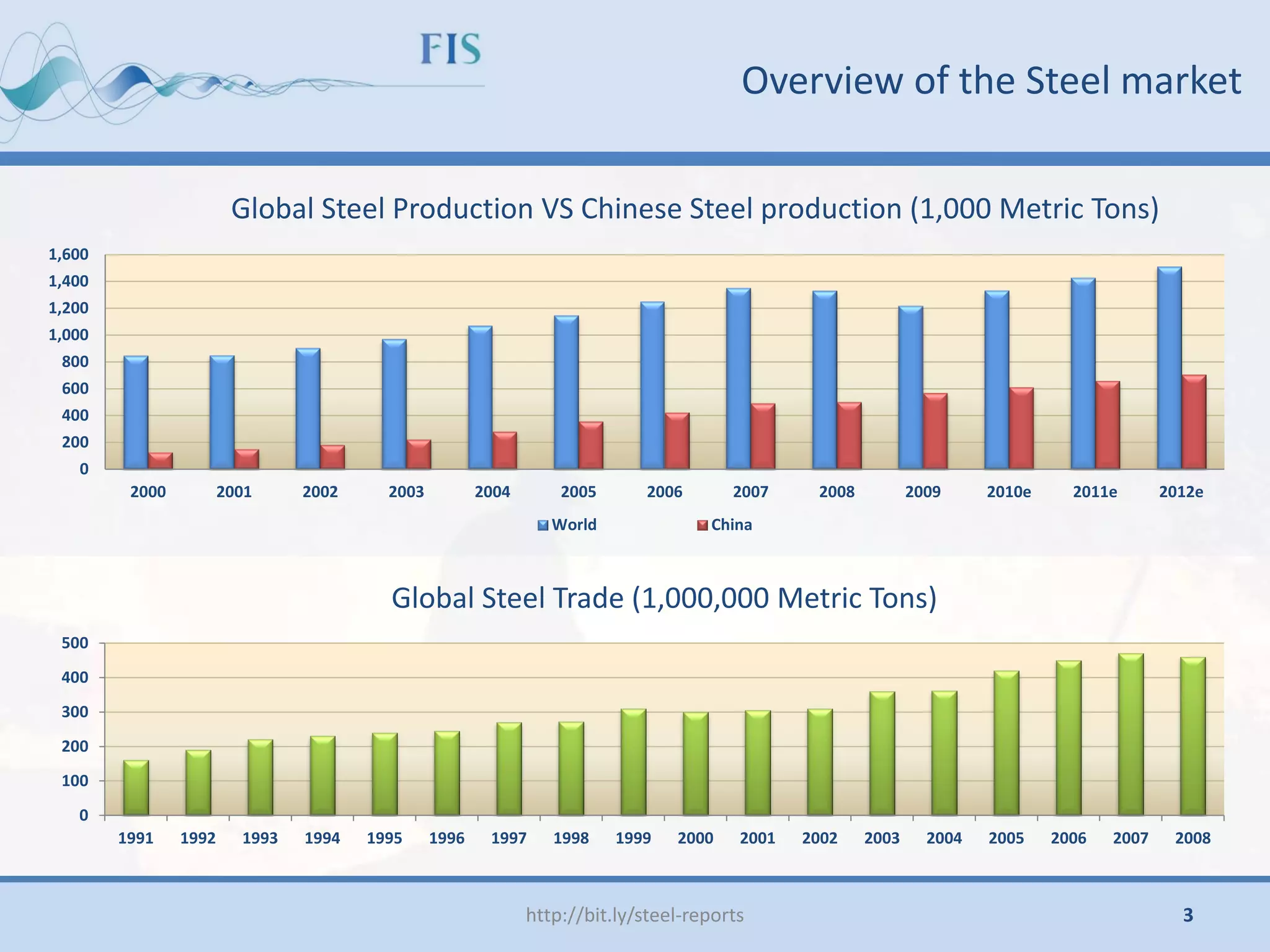

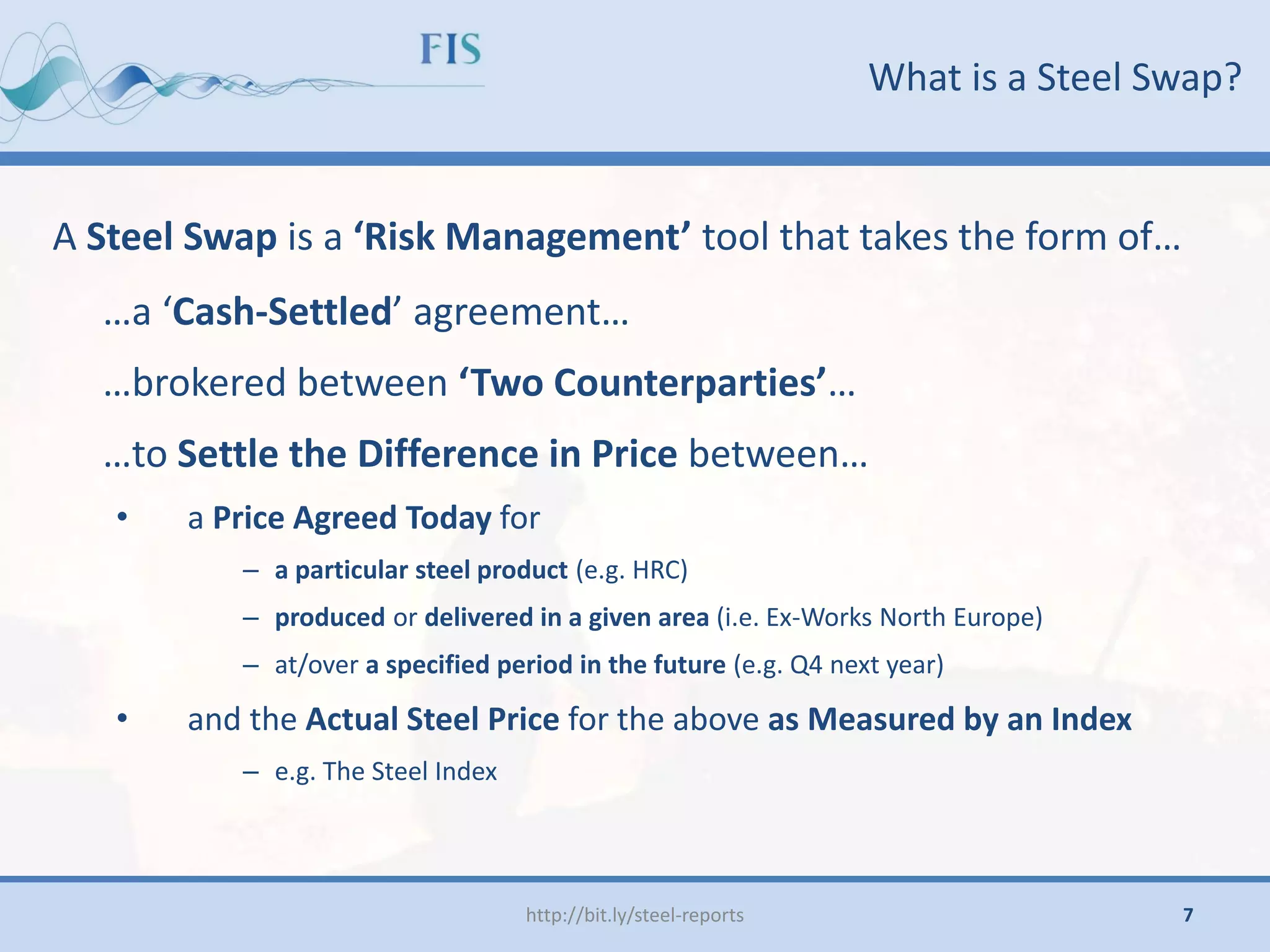

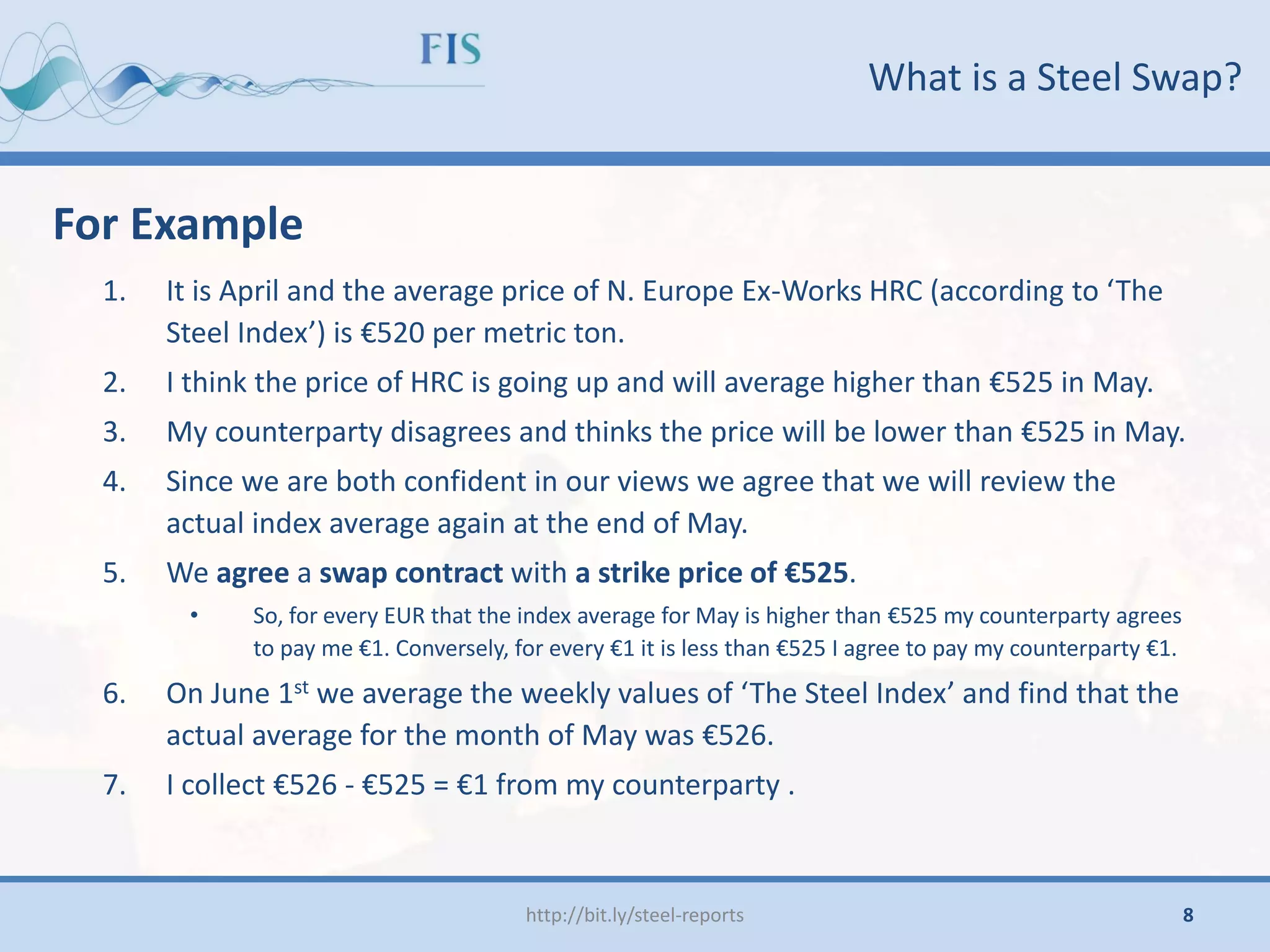

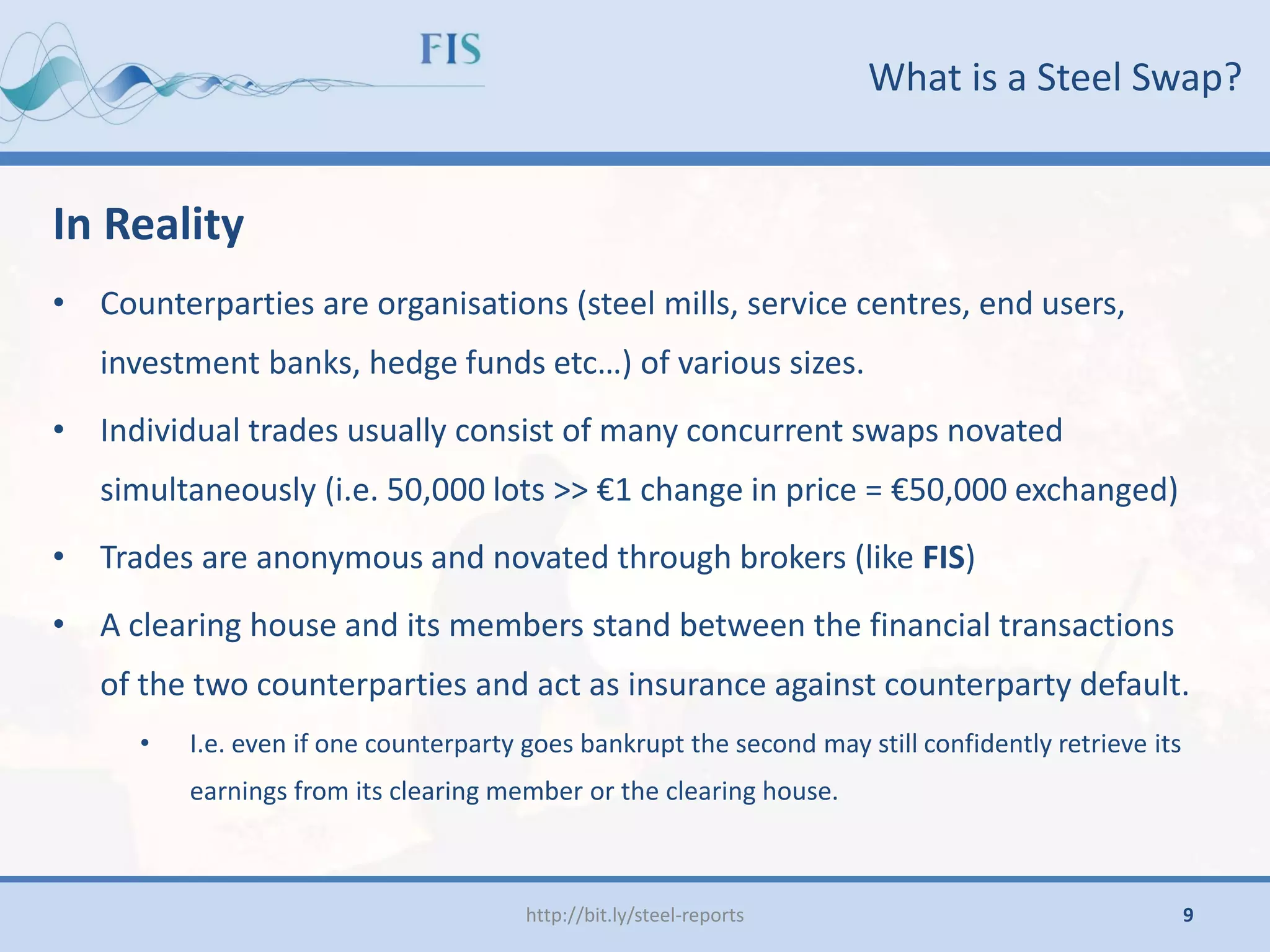

This document provides an overview of steel swaps and how they can be used to manage risk in the volatile steel market. It defines a steel swap as a cash-settled agreement between two counterparties to settle the price difference between a future steel price agreed today and the actual future price measured by an index. Examples show how a steel mill can use swaps to guarantee revenue from future production. The document also outlines available steel swap contracts and indexes.

![http://bit.ly/steel-reports

Spot [08/11] 511 [ -4 ] MTD [NOV] 513.00

QTD [Q4] 531.50 YTD [2010] 527.16

Hot Roll Coil - Northern Europe [ EUR / MT ]

TSI ( 05/2006 -11/2010 )

Spot [08/11] 652 [ 1 ] MTD [NOV] 641.78

QTD [Q4] 641.45 YTD [2010] 619.63

Hot Roll Coil - China [ USD / MT ]

Cleatrade ( 01/2009 -11/2010 )

Volatility in the Steel Markets

• Steel prices are extremely volatile making it very difficult to predict future cash-flows.

• A reliable ‘risk management’ tool to control exposure to volatility is clearly needed.

• Such a mechanism allows for flexible forecasting of [ costs / revenues ] into the future.

5](https://image.slidesharecdn.com/steelswapsexplained-101118111445-phpapp01/75/Steel-Swaps-Explained-5-2048.jpg)

![http://bit.ly/steel-reports

-400

-200

0

200

400

600

800

430 450 470 490 510 530

[

Profit

|

Loss

]

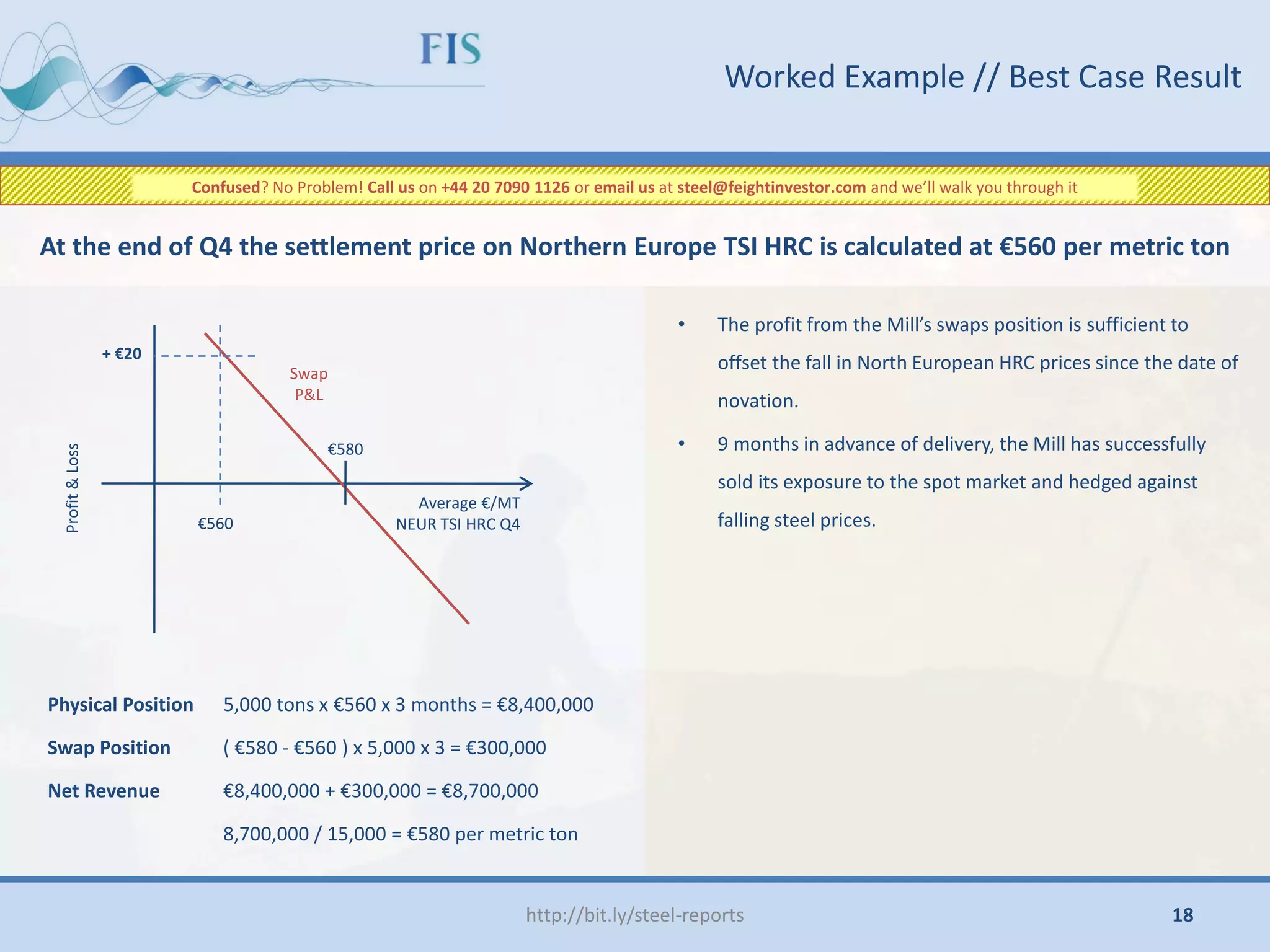

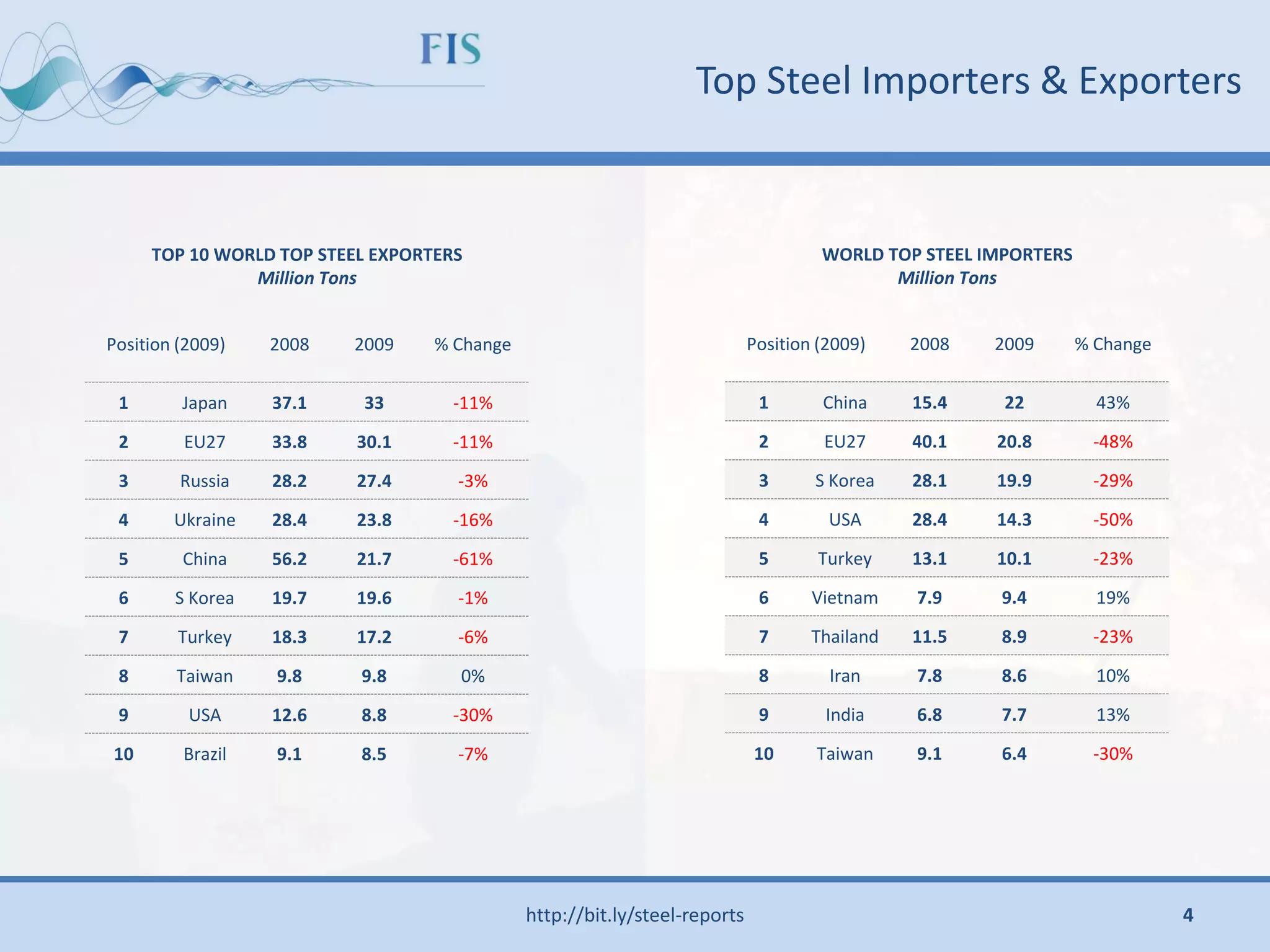

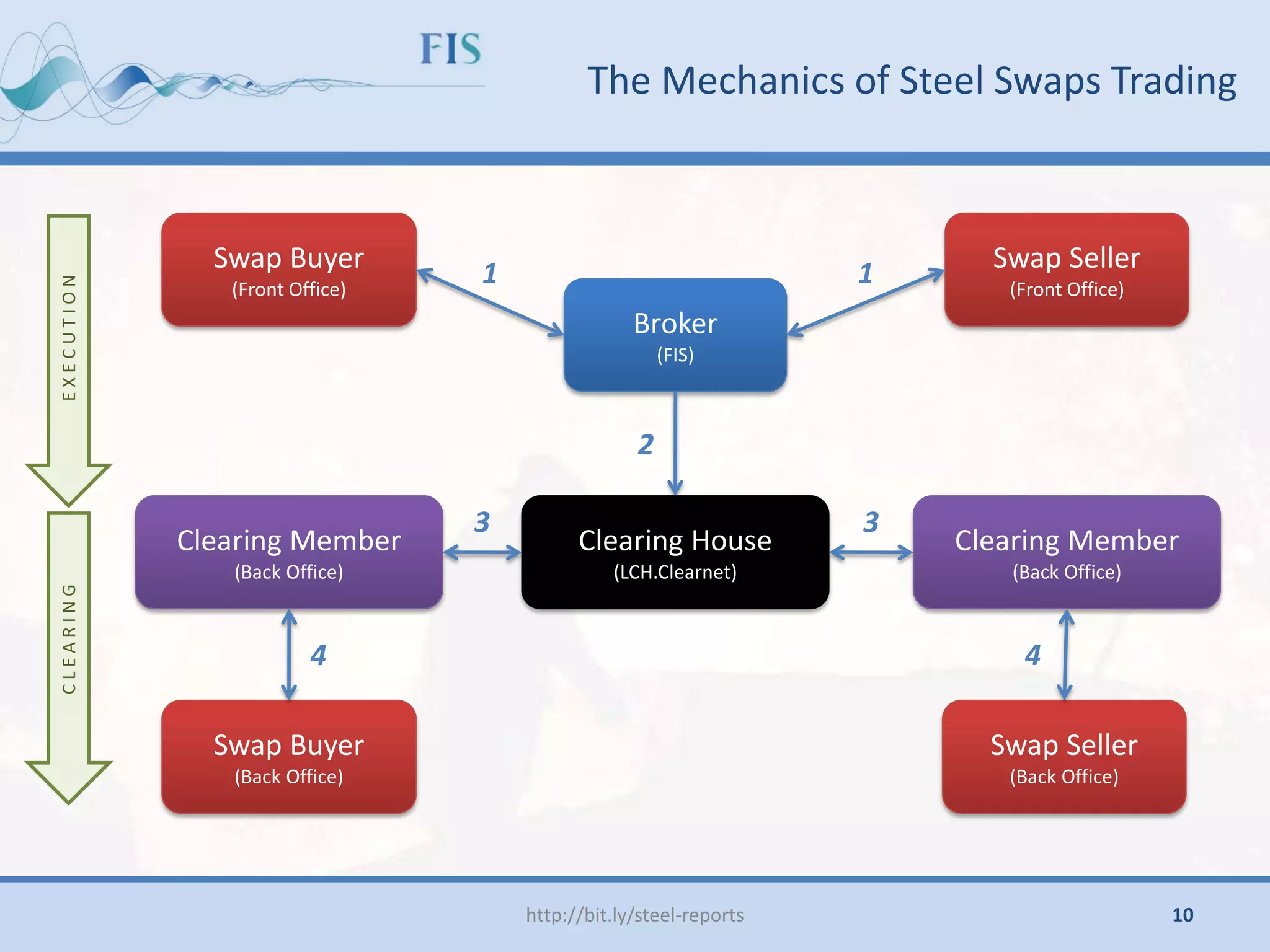

Physical Position Swap Position

Price per MT

Taking a swaps position with the

opposite [ profit / loss ] to your natural

position in the physical market results in

the [ profits / losses ] from each position

cancelling each other out.

The position can be held to maturity (for

cash settlement) or flexibly reversed

(closed out) by taking a second swap

position that is equal and opposite to

your first swap position.

The size of the position and overall effect

on your net market exposure is highly

flexible.

So whether steel prices increase or

decrease, the net [cost / revenue] you

[pay / receive] is thus fixed relative to

the spot market

Combining Natural Exposure with Swaps

12](https://image.slidesharecdn.com/steelswapsexplained-101118111445-phpapp01/75/Steel-Swaps-Explained-12-2048.jpg)